BENEFITS of using a Customs Broker

BENEFITS of using a Customs Broker

AGENTS ON CALL

TICKETED SUPPORT – click below to open up a quote request now!

Why use Tobecan importclear?

We do the heavy lifting

Tobecan importclear was created with the novice importer in mind. We are experts in the import shipping process who make importing easier by streamlining and simplifying the process. We give our customers the tools and resources to make your import to CHINA smooth and trouble free.

If you have just purchased goods in a foreign country and are ready to ship them to CHINA, simply fill out our quote form and you are well on your way to having your shipment cleared and delivered.

Our customer service is superior

Tobecan importclear is on call to answer any questions you have regarding importing to CHINA and customs compliance. Our highly trained team of customs brokerage experts is on call to guide you through each shipment. From personal phone consultations to prompt responses to emails, we work to make your import experience easier.

We are a licensed customs broker and freight forwarder

Customs brokers are licensed to act as agents for importers of goods to CHINA. Customs brokers provide release instructions to China Customs as well as other government agencies to permit the flow of imported goods to CHINA. Customs brokers classify goods according to the current China Tariff to apply duties and taxes owed to China Customs. We keep abreast of constantly changing rules and regulations to assure all importers of record are compliant. When we finish clearing your goods through ocean ports and airports, we also offer last mile delivery of your freight to its final destination,

We use technology to streamline the importing process

Our online system, software and direct connection to China Customs allows us to process your EDI’s, entries and clearances quickly and efficiently. We continually keep up to date w your shipments via email, text notifications.

We provide importers with the tools and resources to import smarter.

From our website with key documents, to our importer knowledge base with links to customs clearance and shipping information, we provide all the resources you need to successfully import your cargo to any Chinese zip code.

Role of a Customs Broker

Tobecan Importclear is a licensed customs broker who clears imports through any all Chinese sea ports and international airports. We streamline the clearance and delivery process on behalf of companies large and small. Tohecan Imporclear can act as a valuable partner on behalf of your business by streamlining your supply chain

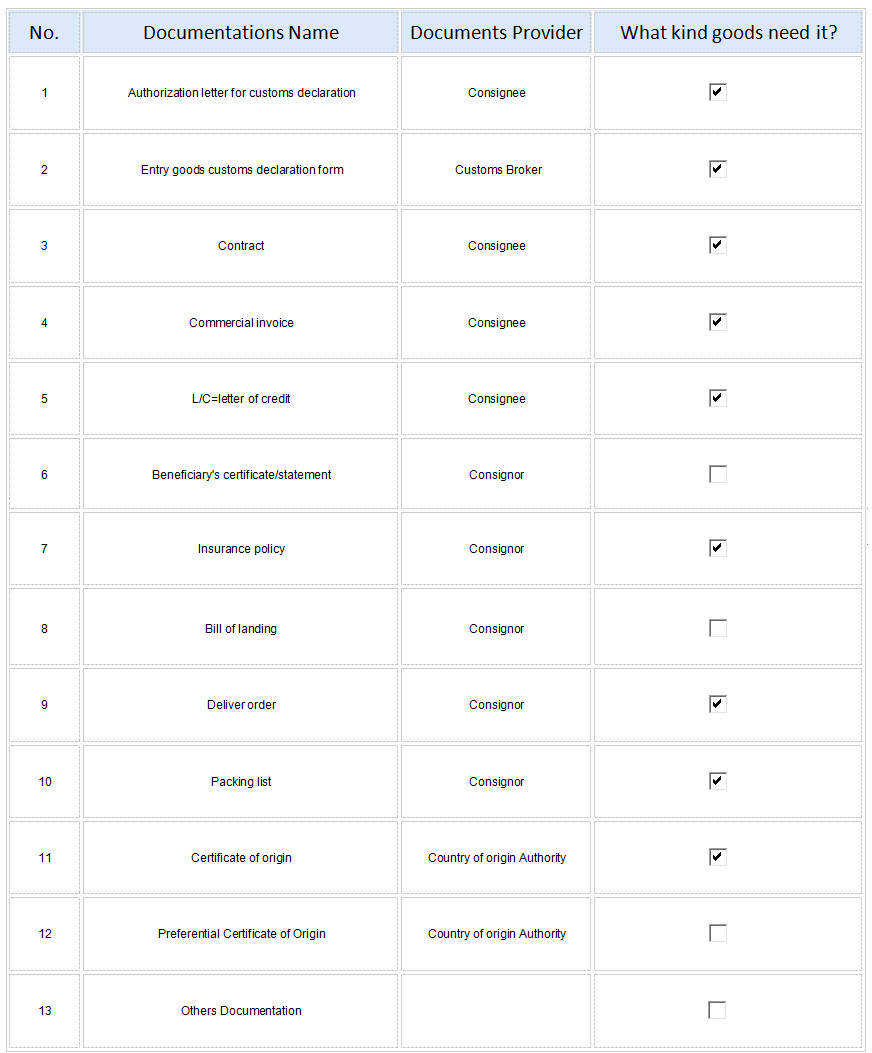

A Chinese customs broker recognizes and produces a variety of legally binding documents needed to import goods into China.

Customs brokers have a close relationship with China Customs Service. to obtain legal clearance for your goods into CHINA.

Customs clearance is required for ALL imports into CHINA regardless if they are duty free or not. Customs brokers also file bonds for goods which temporarily leave and then re enter China. These are called carnets.

China Import Customs Duty, Tax Overview :

All commodities importing into china, need pay the 3 types tariffs:

I. Customs Duty

II. Value-added tax

III. Consumption tax

The valuation method is CIF (Cost, Insurance and Freight), which means that the import duty and taxes payable are calculated on the complete shipping value, which includes the cost of the imported goods.

These tariffs rate depend on the different types of commodities, countries, years and import way.

I. China Customs duty for imported commodities :

China Customs duties include import and export duties, with nearly 9000 items taxed, according to China’s Customs Tariff Implementation Plan (“ china tariff schedule ”). Customs duties are computed either on an ad valorem basis or quantity basis.

China Duty rates on import goods consist of:

1. General duty rates;

2. Most-favored-nation duty (MFN) rates;

3. Conventional duty rates;

4. Special preferential duty rates;

5. Tariff rate quota (TRQ) duty rates; and,

6. Temporary duty rates

1. General duty rates

General duty rates are applied to imported goods originating from countries or territories that are not covered in any agreements or treaties, or of unknown places of origin.

2. MFN duty rates

MFN (most-favored-nations) rates are the most commonly adopted import duty rates. They are much lower than the general rates which apply to non-MFN nations. They apply to the following goods:

• Goods imported to China from WTO member countries;

• Goods originating from countries or territories which have concluded bilateral trade agreements containing provisions on MFN treatment with China; and,

• Goods that originated from China.

3. Conventional duty rates and special preferential duty rates

Conventional duty rates are applied to imported goods that originate from countries or territories that have entered into regional trade agreements containing preferential provisions on duty rates with China.

4. Special preferential duty rates

Special preferential duty rates are applied to imported goods originating from countries or territories with trade agreements containing special preferential duty provisions with China. They are generally lower than MFN rates and conventional duty rates.

5. Tariff rate quota duty rates

Under tariff rate quota (TRQ) schemes, goods imported within the quota are subject to a lower tariff rate, and goods imported beyond the quota are subject to higher tariff rates. For example, the TRQ rate for importing wheat within the quota is one percent – substantially lower than the MFN duty rate of 65% and the general duty rate of 130%.

6. Temporary duty rates

China also sets temporary duty rates for certain imported goods in order to boost imports and meet domestic demand. In 2016, China implemented temporary tax rates, which are even lower than the MFN tariffs on more than 787 imported commodities, including on diapers (2%), sunglasses (6%), kaolin (1%), and skincare products (2%).

II. Value-added Tax for imported goods

All goods imported into China are subject to the nation’s value-added tax (VAT) of either 13 percent or 17 percent. The 13 percent tax is available for certain goods that fall mainly within the categories of agricultural and utility items, while the 17 percent tax applies to other goods subject to the VAT tax.

The input VAT (Sales x VAT rate), which is the VAT amount paid when purchasing products or taxable services, can often be used for deduction against output VAT, which is the VAT amount charged to the buyer by the seller of a good or taxable service.

III. Consumption Tax for imported goods

China’s consumption tax (CT) is imposed on companies and organizations who manufacture and import taxable products, process taxable products under consignment, or sell taxable products.

Imported products taxable under China’s consumption tax include those that are harmful to one’s health like tobacco or alcohol, luxury goods like jewelry and cosmetics, and high-end products such as passenger cars and motorcycles.

For imported goods, consumption tax varies depending on the type of product being brought into the country. Calculating consumption tax can be done by using either the ad valorem or quantity-based method.

IV. Cross-Border e-Commerce import tax:

There are two circumstances can apply Cross-Border e-Commerce import:

1. goods purchased from merchants registered in China's cross-border e-commerce network, or

2. goods purchased from any overseas merchant AND shipped by a courier company that is able to present three required documents (commercial invoice, airway bill, and proof of payment), and who can take legal responsibility for the import

Personal imports of these types, with a customs value (CIF value) up to CNY 5,000, and where the accumulated transaction value has not surpassed the personal annual limit of CNY 26,000, are exempt from import duty, and subject to 70% of the applicable VAT and Consumption Tax rate.

Imports which exceed these limits will be subject to all duties and taxes. NB: Only products in the positive list (i.e. a list of products approved by China's Ministry of Finance) can be imported under this regime.