Secured, Affordable & Reliable

Secured, Affordable & Reliable I had three problems today

1.What is the difference between Customs Value and Statistical Value?

2.Will VAT count VAT ADSUJUMENT?

3.How is License Value calculated?

these three questions

1.Customs Value和 Statistical Value

1.The customs value or statistical value is the value of a product at the frontier of the EU, and is used by Customs in order to be able to levy duties etc. upon import.

As the frontier of the EU is an imaginary line somewhere at sea, Customs sets the customs value equal to the CIF value upon import.

A customs value also applies to export, but it has more of a statistical function. For exports, the FOB value is used. It is therefore possible that, on the basis of the terms and conditions for delivery used for the trade transaction, a value must be added to or deducted from the invoice value.

2.Will VAT ADSUJUMENT be calculated?

Import VAT explained

When importing from outside of the UK, you will be required to pay VAT on all the costs to purchase the goods and transport them to you in the UK.

Here is an example of how you can get an approximate calculation on the amount of VAT you will need to pay after customs clearance:

VAT = 20% of (UK Duty + Shipping + Cost of the goods)

If you pay your supplier £4000 for your goods, the UK Duty rating for these goods will come to 3.5%, and the shipping quote is £400. (based on early 2020 rates)

UK Duty = 3.5% of £4000 = £140.00

So VAT = 20% of (£140 + £400 + £4000) = £908

here fore the final import value of total duties and taxes payable would be £1048 (£140 for UK Duty as well as £908 for VAT), plus the £400 shipping cost

In reality, VAT is calculated differently as any two companies importing identical products for the same cost are required to pay the same Duty and VAT, even if the shipping costs vary.

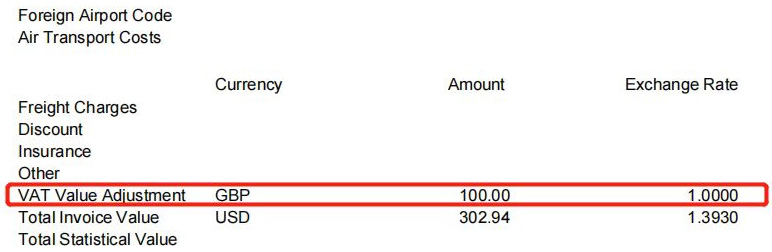

HMRC use VAT Value Adjustment. The shipping cost to get the goods to the UK border is added to a VAT Value Adjust figure which depends on the size of the shipment – this is an average of UK charges to clear and deliver the goods into circulation within the United Kingdom.

3.Licence value

This is the adjusted amount, which is after adding the VAT ADJUSTMENT.